are inherited annuity payments taxable

One of the biggest advantages of an. You may also have to pay fees to cash out the annuity.

How To Avoid Paying Taxes On An Inherited Annuity By Jenniferlangfinancialservices Com Youtube

Either way you will pay regular taxes only on the interest.

. If you inherit an annuity you may have to pay taxes on your money. Tax Rate on an Inherited Annuity. So the tax rate on an inherited annuity is your regular income tax.

The proceeds of inheritance are taxable. Often those inheriting an annuity choose a lump-sum payout. If a beneficiary opts to receive the money all at once they must pay taxes immediately.

FYI periodical payments are subject to ordinary income taxation. In that case the taxation is much simpler. The payments received from an annuity are treated as ordinary income which could be as high as a 37 marginal tax rate depending on your tax bracket.

Inherited annuities are considered to be taxable income for the beneficiary. Because your wife chose to cash in the annuity a portion of what she received will be income from the invested funds. If you are the beneficiary and inherit an annuity the same tax rules apply.

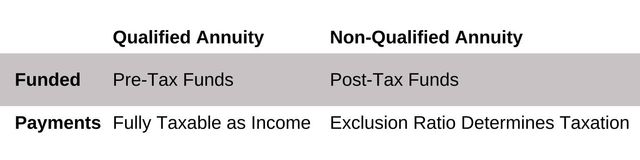

If you keep the annuity you will usually have to start taking withdrawals. Tax-deferred means you will pay ordinary. The main rule about taxation with an inherited annuity or one that is purchased is that any principal that is funded.

Annuities are taxed as ordinary income when inherited. Inherited Annuity Tax Implications Once the money is inside of an annuity it grows tax-free or rather tax-deferred so the policyholder does not have to pay taxes on the growing account. Youll pay tax on everything above the cost that the original annuity.

Annuities are also included in the estate for federal estate tax calculations. Taxation Unlike other investments the named beneficiary of a nonqualified annuity does not get a step-up in tax basis. One you might not have heard of is called an annuity stretch It gives non-spouse beneficiaries a way to receive income and defer taxes.

The good news is that the beneficiary. Some portion of the annuity is generally taxable to you. You can use the following calculations to calculate the taxable amount of your annuity.

An individual who inherits a non-qualified annuity can take a lump-sum cash payment or a stream of payments. Although contributions to a non-qualified annuity are not taxable growth and earnings on the initial investment are tax-deferred. Is inherited annuity taxable.

The exact amount of the payment that is taxable will vary depending on many factors. The earnings are taxable over the life of the payments. The payments received from an annuity are treated as ordinary income which could be as high as a 37 marginal tax rate depending on your tax bracket.

Is A Survivor Annuity Death Benefit Taxable Safemoney Com

/dotdash-life-insurance-vs-annuity-Final-dad081669ace474982afc4fcfcd27f0a.jpg)

Life Insurance Vs Annuity What S The Difference

Pass Money To Heirs Tax Free How To Avoid Taxes On Inheritance

What Is The Best Thing To Do With An Inherited Annuity Due

Annuity Tax Consequences Taxes And Selling Annuity Settlements

Are Annuity Tax Benefits Taxable How Are Benefits Paid Out

Annuity Beneficiaries Inheriting An Annuity At Death 2022

If You Inherit An Annuity How Are You Taxed Nl Brand Reviews

Publication 575 2021 Pension And Annuity Income Internal Revenue Service

Fixed Annuities And Taxes Match With A Local Agent Trusted Choice

Annuity Beneficiaries Inheriting An Annuity At Death 2022

How Does Inheriting An Annuity Work Smartasset

Annuity Beneficiaries Inheriting An Annuity After Death

Do I Have To Pay Taxes When I Inherit Money

How Are Inherited Annuities Taxed